Top 10 Documentation Errors in CCM & RPM

OnCare360

Dec 30, 2025

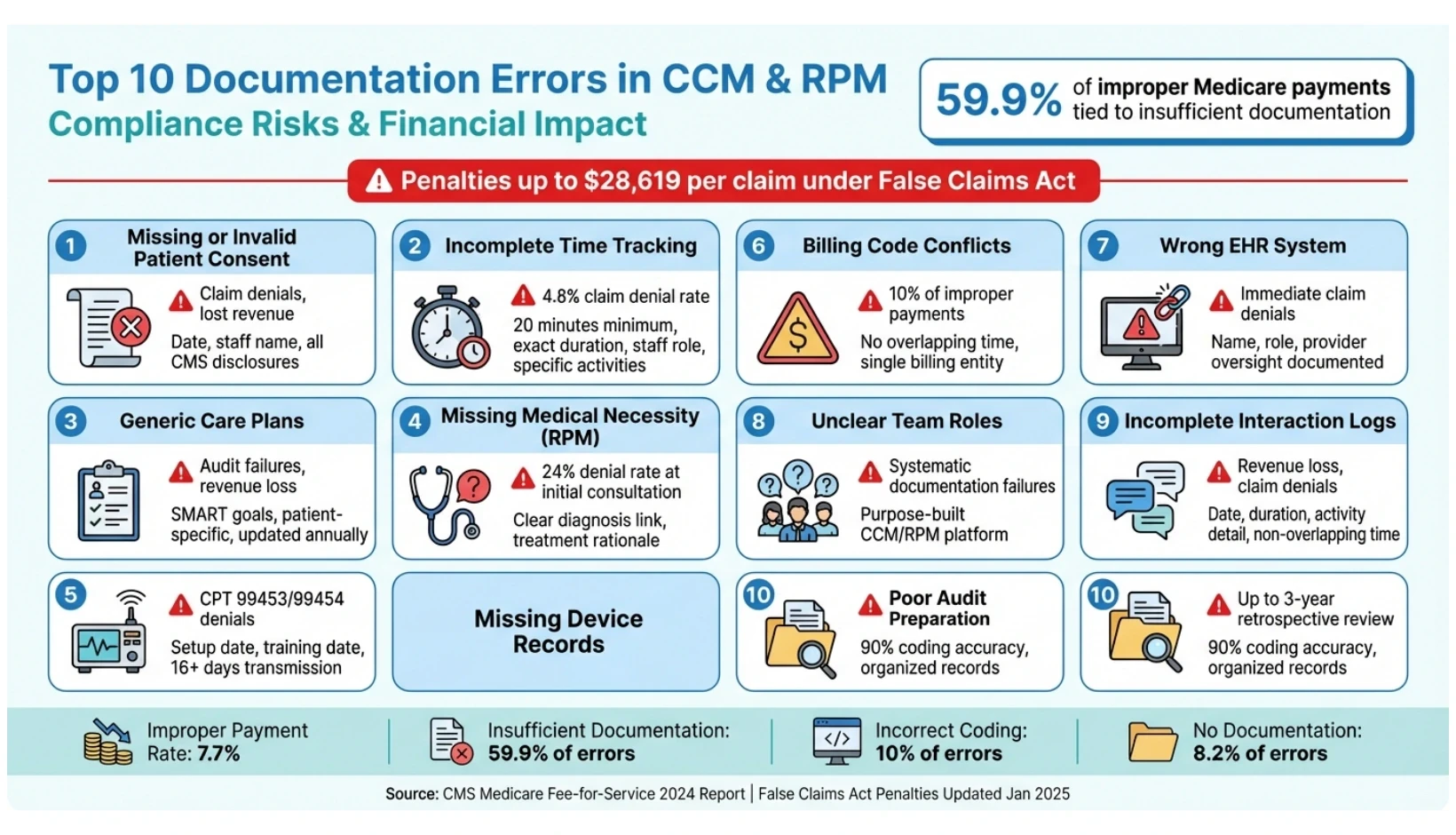

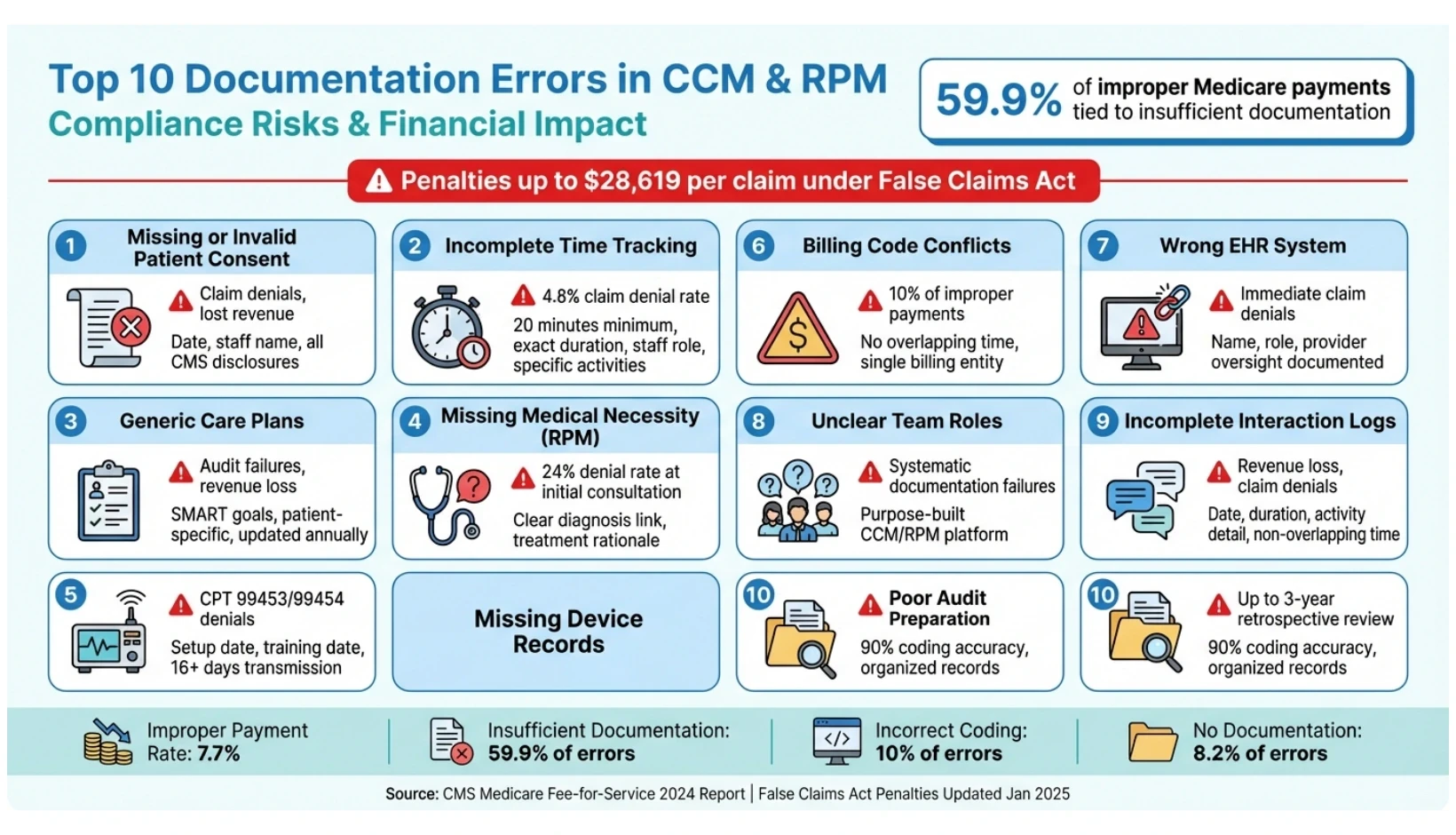

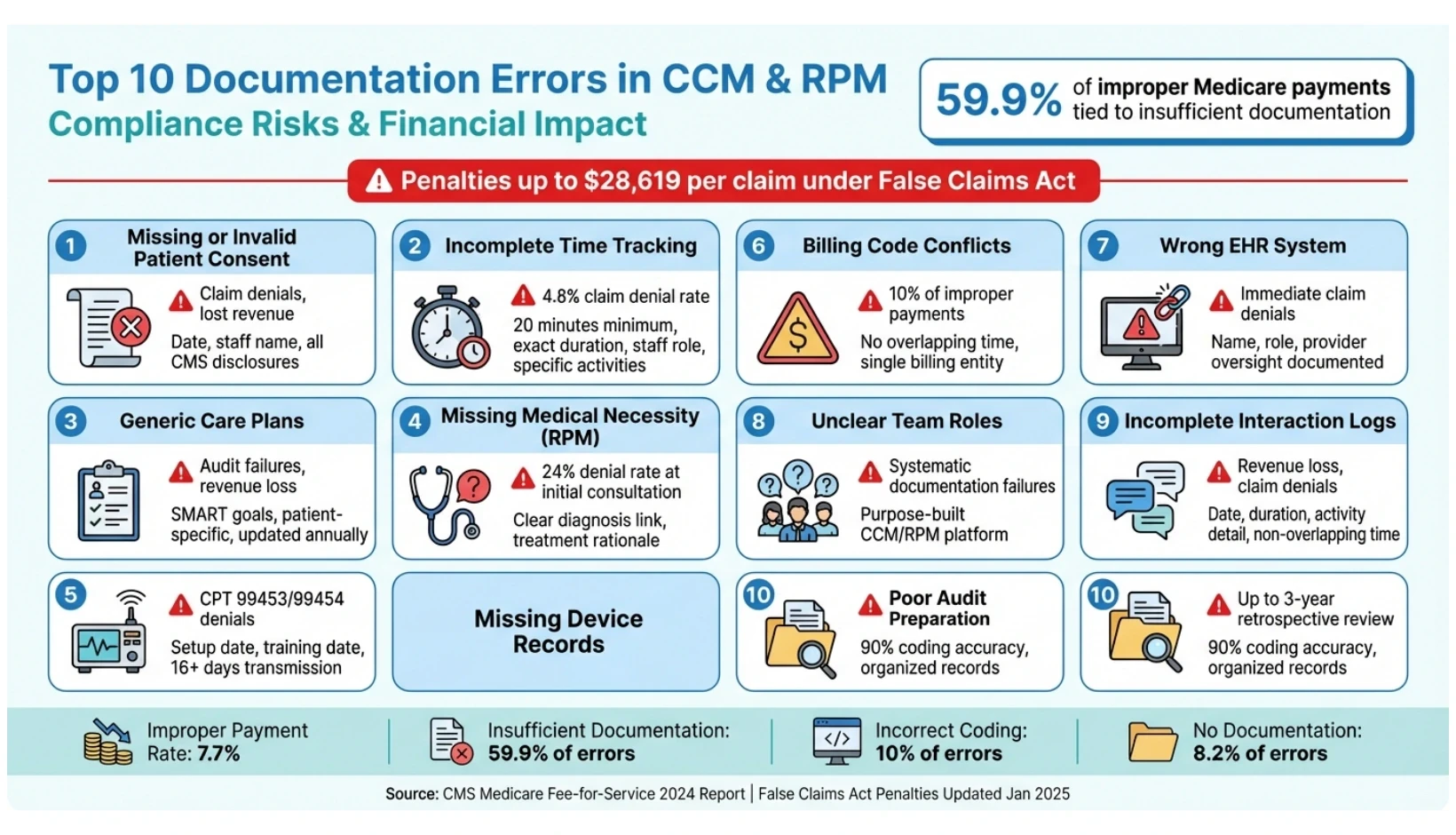

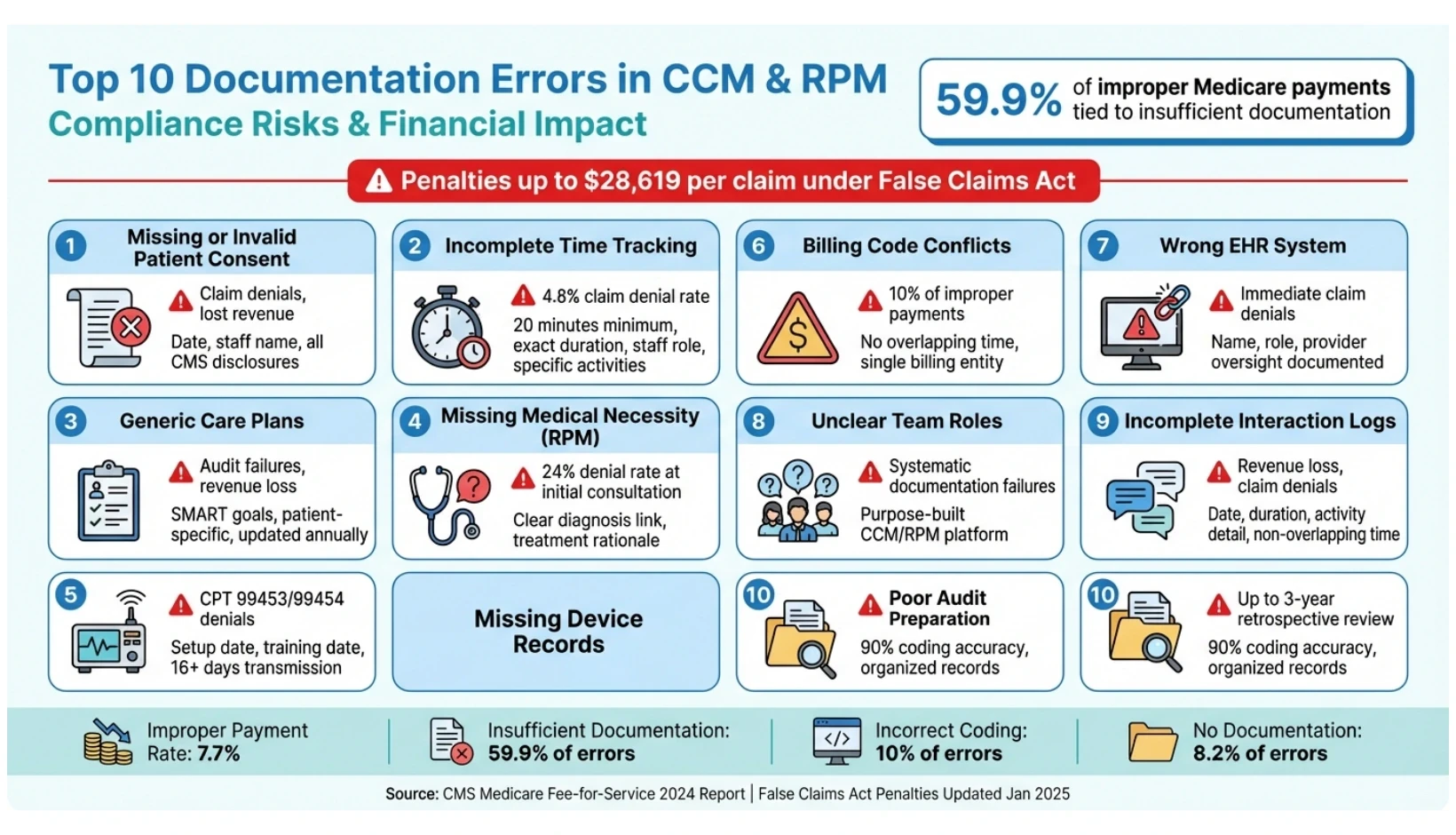

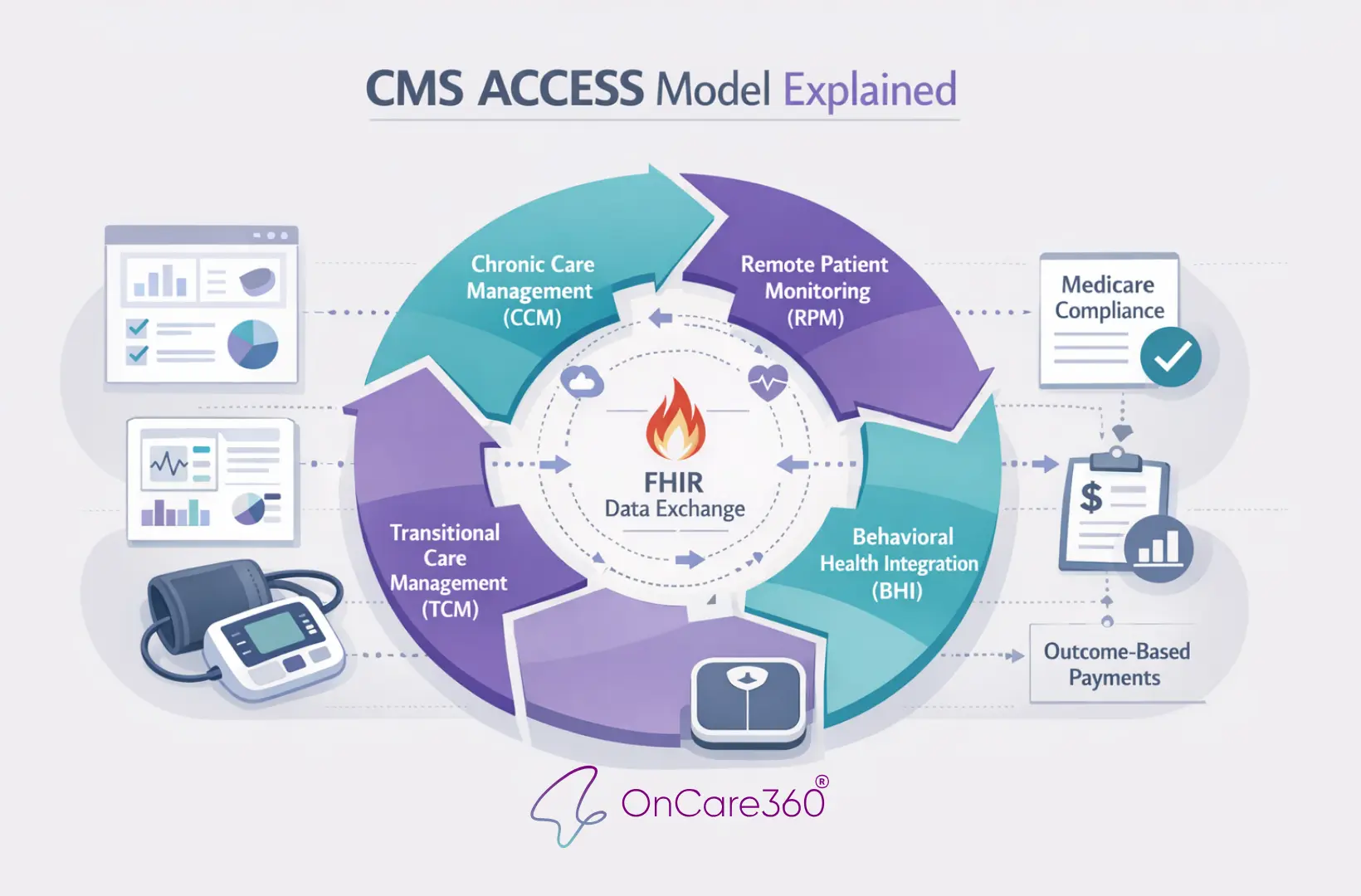

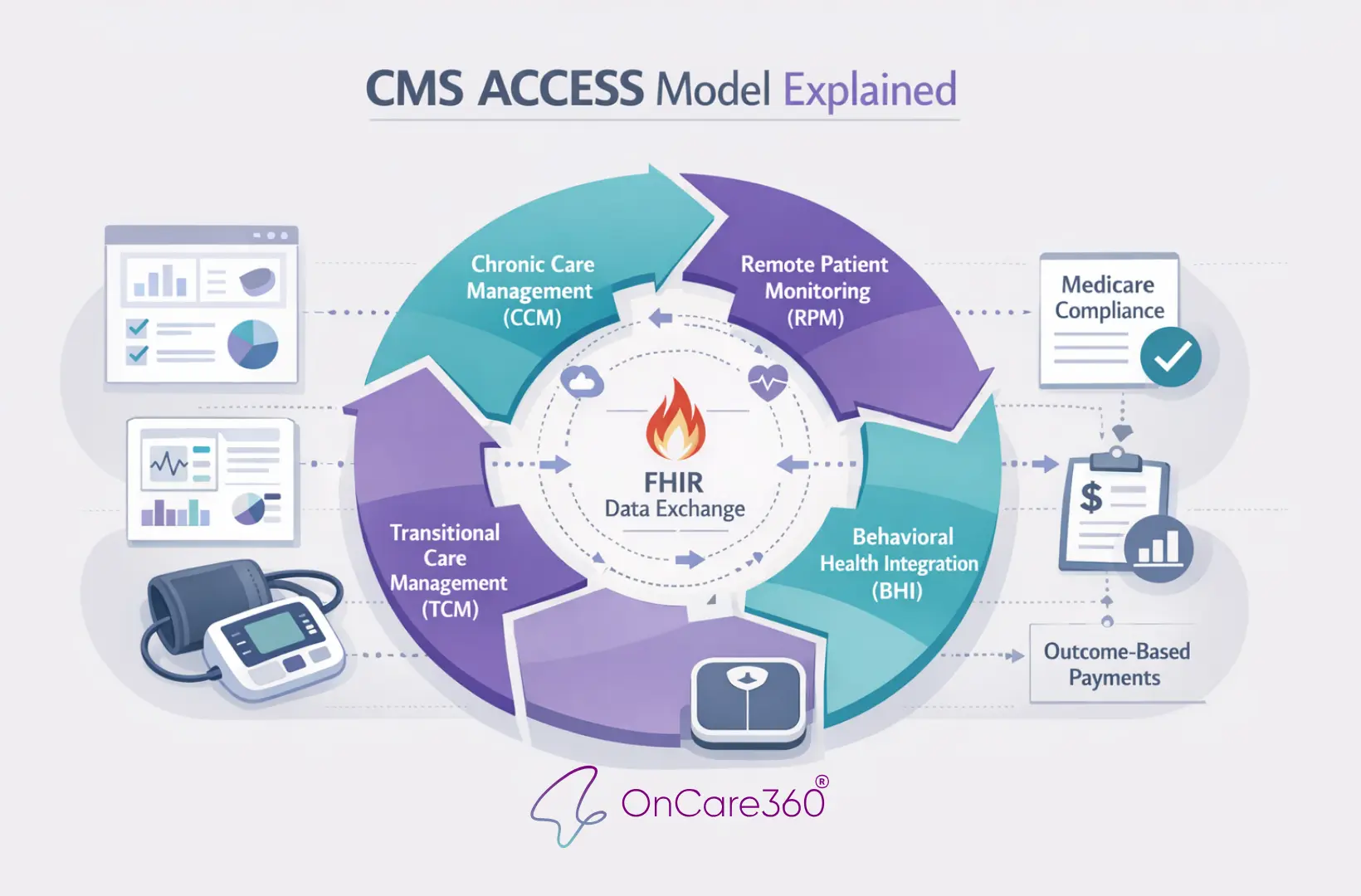

Documentation errors in Chronic Care Management (CCM) and Remote Patient Monitoring (RPM) directly impact compliance, revenue, and audit readiness. Missing consent forms, incomplete time tracking, and vague care plans are among the most common issues, with 59.9% of improper Medicare payments tied to insufficient documentation. These errors expose practices to claim denials, revenue recovery, and penalties up to $28,619 per claim under the False Claims Act.

This article explores the 10 most frequent documentation mistakes in CCM and RPM, their financial and operational risks, and actionable solutions to improve compliance. Key areas include patient consent, time tracking, care plan accuracy, medical necessity, and CCM billing essentials for audit preparation. Learn how to safeguard your practice with precise workflows and technology tailored for CMS requirements.

Top 10 CCM and RPM Documentation Errors with Compliance Impact

1. Missing or Invalid Patient Consent

Patient consent plays a critical role in Chronic Care Management (CCM) and Remote Patient Monitoring (RPM) claims. Without proper documentation, your practice cannot prove that patients voluntarily enrolled or understood their rights and financial responsibilities. This gap can lead to claim denials and lost revenue.

Compliance with CMS Documentation Requirements

The Centers for Medicare & Medicaid Services (CMS) accepts both verbal and written consent for CCM and RPM services, but the documentation must meet specific requirements. Your records should confirm that patients were informed about cost-sharing obligations (such as deductibles and copays), their right to opt out at any time (with changes effective at the end of the billing month), and the rule that only one provider can bill for CCM services during a given period.

Each consent record needs to include:

The date consent was obtained.

The name and role of the staff member who secured it.

Confirmation that all required elements were explained to the patient.

Unlike other programs, CCM consent remains valid indefinitely unless the patient revokes it or switches providers. There’s no need for annual renewals. If two providers mistakenly bill for the same patient in a single month, CMS typically pays the provider with the earlier consent date on record. Keeping thorough documentation ensures compliance and strengthens your position during audits.

Audit Readiness and Defensibility of Records

Auditors don’t just check for the existence of consent - they also assess whether your documentation clearly outlines what was communicated to the patient during enrollment. Missing elements in consent records are a common compliance issue. To prepare for audits, store all consent documentation in a consistent and easily accessible location within your electronic health record (EHR) system. Each entry should link the consent to a specific clinical staff member, as required by CMS standards.

Impact on Billing Accuracy and Revenue Retention

Incomplete or missing consent is a leading cause of claim denials and revenue loss. Without clear documentation, your practice cannot confirm that patients voluntarily enrolled or understood their financial responsibilities, putting related claims at risk. To avoid accidental double billing - and the denials that follow - confirm that patients aren’t already receiving CCM services from another provider before enrollment.

Streamlining Compliance with Technology and Workflows

To reduce errors and protect revenue, consider using a standardized consent checklist to ensure your staff consistently covers all required disclosures during enrollment. Technology can also help by flagging patients who lack documented consent and securely storing records for the required retention period - up to 10 years in some cases. Regular internal audits can catch missing or incomplete consent forms before external auditors do, helping to safeguard your practice’s financial health.

2. Incomplete or Unverifiable Time Tracking

Accurate time tracking is a cornerstone for billing Chronic Care Management (CCM) and Remote Patient Monitoring (RPM) services. Without precise logs of staff time, you cannot substantiate the Centers for Medicare and Medicaid Services (CMS) requirement of 20 minutes per month for basic CCM (CPT 99490) and RPM treatment management (CPT 99457).

Compliance with CMS Documentation Requirements

CMS mandates that time logs include four key elements: the date of service, the exact duration in minutes (not rounded), a detailed description of the activity, and the name and clinical role of the staff member involved. Generic entries like "care coordination – 20 minutes" are insufficient and may fail an audit. Instead, documentation should specifically describe the activities performed, such as "10 minutes reviewing lab results and updating the diabetes care plan."

Qualifying activities include tasks like care plan development, medication reconciliation, coordination with specialists, patient education, and interpreting physiological data from RPM devices. However, time spent on in-person visits or same-day Evaluation and Management (E/M) services is excluded. For patients receiving both CCM and RPM in the same month, you must document a total of 40 minutes - 20 minutes for each program separately, as CMS prohibits double-counting the same time block.

"A note that simply says '20 minutes of CCM activity' is highly likely to be identified as noncompliant." - DrKumo

Detailed documentation not only meets CMS requirements but also strengthens your audit trail.

Audit Readiness and Defensibility of Records

Beyond compliance, audit readiness hinges on maintaining defensible, precise time logs. Medicare audits often evaluate whether your documentation demonstrates how the recorded time directly addresses a patient's chronic conditions and associated risks. Incomplete or vague entries can raise red flags. Nationally, the accuracy rate for proper Medicare payments is 92.3%, with an improper payment rate of 7.7%, largely due to insufficient documentation. If your records fail to justify the services billed, CMS may deny payment or seek to recover funds as overpayments.

To bolster audit defense, conduct monthly or quarterly internal reviews of random charts to confirm they meet the 20-minute threshold and include itemized activity logs. Ensure every record includes appropriate signatures; if a signature is handwritten and illegible, provide a signature log or attestation. Automated tools that generate time-stamped, immutable audit trails can mitigate the risk of manual errors and ensure compliance with Medicare's minute-by-minute tracking requirements.

Impact on Billing Accuracy and Revenue Retention

Failure to meet documentation standards directly impacts billing accuracy and revenue. Incomplete time tracking can result in claim denial rates as high as 4.8%. When staff fail to log activities in real-time or rely on generic templates, practices risk underbilling (losing revenue) or overbilling (triggering audits and potential recoupments). Conversely, thorough documentation helps secure the full reimbursement for care management services and shields practices from compliance penalties.

Well-documented CCM programs can also improve patient outcomes. For instance, proactive care management has been shown to reduce hospitalizations by up to 65% and emergency room visits by 44.3% for patients with COPD, while lowering the risk of hospital readmission by 21% for those with heart failure or COPD. These outcomes depend on demonstrating consistent, high-quality care coordination, which begins with accurate time tracking.

Ease of Implementation with Technology and Workflows

Specialized care management software simplifies compliance by creating time-stamped, unalterable audit trails, removing the need for manual entry. Many standard electronic health records (EHRs) lack features like care plan versioning or aggregation of non-face-to-face time, increasing the risk of documentation errors. Purpose-built platforms can automate reminders for patient outreach, helping staff consistently meet the 20-minute monthly threshold.

Standardizing workflows with a checklist can further improve accuracy. Include prompts for staff to record the date, duration, role, and specific activity for each patient interaction. Train staff regularly on real-time time tracking and verify that patients aren’t receiving overlapping services, such as Transitional Care Management (TCM).

CPT Code | Service Type | Minimum Time Requirement | Key Documentation Focus |

|---|---|---|---|

99490 | Basic CCM | 20 minutes/month | Non-face-to-face clinical staff time |

99457 | RPM Treatment | 20 minutes/month | Interactive time and data interpretation |

99458 | RPM Add-on | +20 minutes (40 total) | Additional interactive time |

99491 | CCM (Provider) | 30 minutes/month | Physician or qualified professional time |

3. Generic, Outdated, or Template-Only Care Plans

Beyond consent and time tracking, the quality of care plans plays a pivotal role in ensuring compliance and maintaining steady revenue. Patient-specific care plans are a cornerstone of compliant Chronic Care Management (CCM) and Remote Patient Monitoring (RPM) billing. Unfortunately, many practices fall into the trap of reusing generic templates, neglecting regular updates, or omitting critical components like measurable goals and coordination details. These oversights are red flags for CMS and auditors, often leading to deeper scrutiny, claim denials, or payment recoupment.

Compliance with CMS Documentation Requirements

CMS mandates that every CCM care plan include specific diagnosis codes, measurable SMART goals, medication management (including allergies), planned interventions, and specialist coordination. All of this must stem from a current, person-centered assessment. Over-reliance on generic templates jeopardizes compliance and raises risks during audits.

To meet CMS standards, care plans should follow the SMART framework - goals must be Specific, Measurable, Actionable, Relevant, and Timed. For instance, instead of a vague directive like "manage hypertension", a care plan should outline clear objectives, such as "reduce systolic blood pressure to below 130 mmHg within six months through medication adjustments and dietary changes." Care plans must also be updated at least annually or whenever a patient’s condition changes. Failure to document these updates can result in noncompliance.

"A CCM care plan should be patient-specific and regularly updated. But in practice, some plans are duplicated from templates, too general to be meaningful, or not revised month-to-month." - Jon-Michial Carter, ChartSpan

CMS also requires that the initial care plan be developed in person by the billing practitioner. While clinical staff can assist with updates, the practitioner must review and sign off on all revisions.

Audit Readiness and Defensibility of Records

Auditors prioritize detailed, patient-specific documentation that demonstrates active care management. Generic or outdated plans are a major warning sign. When care plans are copied from templates or lack regular updates, they weaken the defensibility of records during Medicare audits.

For audit readiness, ensure care plans are accessible 24/7 to the entire care team and available to patients or their caregivers in electronic or paper formats. Every revision should be documented with a date stamp and a clear explanation of the changes - such as adding a new specialist referral or adjusting medications post-hospitalization. Purpose-built CCM software can simplify this process, offering automated versioning and real-time tracking that standard EHRs often lack. This level of documentation not only satisfies auditors but also supports accurate billing and revenue retention.

Required Care Plan Element | Description for Compliance |

|---|---|

Problem List | Chronic conditions with specific diagnosis codes |

Measurable Goals | SMART goals: Specific, Measurable, Actionable, Relevant, Timed |

Medication Management | Current medication list and allergy details |

Planned Interventions | Therapies, monitoring strategies, and assigned responsibilities |

Coordination Details | Collaboration with specialists and external agencies |

Periodic Review | Updates and revisions scheduled at least every 12 months |

Impact on Billing Accuracy and Revenue Retention

Neglecting compliant care plans can directly jeopardize revenue. Claims for CCM (CPT 99490) and Principal Care Management are often denied if care plans fail to meet CMS requirements for specificity, accessibility, and documentation. With annual revenue from a single CCM patient ranging between $1,130.23 and $2,238.68, inadequate care plans put significant income at risk. Moreover, generic templates often fail to demonstrate medical necessity and a clear rationale for monitoring - key elements for RPM reimbursement.

When care plans are not updated to reflect clinical changes, practices risk billing errors. For example, if a patient is hospitalized and the care plan isn’t updated within seven days to include reconciled medications and follow-up instructions, the practice may fail to meet Transitional Care Management (TCM) documentation requirements, forfeiting reimbursement. On the other hand, regularly updated care plans help ensure full reimbursement and protect against compliance penalties.

"In the eyes of CMS, if it is not documented, it did not happen." - Justin Brochetti, CEO, Intelligence Factory

Ease of Implementation with Technology and Workflows

Specialized care management software can significantly simplify compliance by creating care plan drafts using real-time patient data, automatically tracking updates, and ensuring all CMS-required elements are included. Many standard EHRs lack features like versioning or the ability to easily share care plans with the entire care team and patients, increasing the likelihood of documentation errors. Purpose-built platforms can also prompt staff to update care plans on a regular schedule and flag overdue revisions.

To move away from generic templates, establish workflows that require customization. Internal templates can serve as a foundation, but clinical staff must tailor sections like planned interventions and symptom management for each patient. For example, two patients with diabetes may have vastly different goals - one focusing on weight loss, the other on preventing hypoglycemia - and care plans should reflect these individualized priorities. Regular internal audits can further ensure care plans remain specific and up to date.

4. Lack of Medical Necessity Documentation for RPM

For Remote Patient Monitoring (RPM) claims to be approved, they must demonstrate that the service is both reasonable and necessary for diagnosing or treating a patient’s condition. Without proper documentation, claims are at risk of being denied, and audits may follow. A common misconception among providers is that enrolling a patient in RPM and collecting device data is enough. However, CMS and auditors require a detailed explanation of why RPM is appropriate for the patient’s specific diagnosis and treatment plan.

Compliance with CMS Documentation Requirements

According to CMS, medical necessity refers to services that are "reasonable and necessary for the diagnosis or treatment of illness or injury or to improve the functioning of a malformed body member". This means documentation must directly link the RPM device to the patient’s condition and treatment plan. Auditors look for a clear order in the medical record’s assessment and plan section, explaining the need for RPM, the expected duration, the type of device, its relevance to the condition, and the physiological metrics being monitored. Each RPM record should be tailored to the patient and updated as needed. For device supply billing (CPT 99454), patients must transmit at least 16 days of data within a 30-day period.

"In order for a claim for services to be paid by Medicare, the ordering practitioner must determine that a service is 'medically necessary' – meaning, it is reasonable and necessary for the diagnosis or treatment of the patient's condition." – Carrie Nixon, Managing Partner, Nixon Law Group

Documentation Element | CMS Requirement / Auditor Expectation |

|---|---|

Patient Relationship | Must be an established patient for RPM |

Condition Type | Must be an acute or chronic condition |

Device Type | Must meet FDA definition of a medical device |

Data Collection | 16 days of readings per 30-day period for billing |

Care Plan Details | Include RPM need, duration, device type, and metrics |

Clinical Oversight | Services must be under general supervision |

This structured approach ensures compliance and prepares providers for audit scrutiny.

Audit Readiness and Defensibility of Records

Audits of RPM services have become more stringent in recent years. As previously mentioned, thorough documentation is essential to defend against penalties. Auditors closely examine treatment plans to confirm that medical necessity is clearly documented. Inadequate records can lead to investigations under the False Claims Act. Some auditors incorrectly demand evidence of a "precipitating event" or worsening of a chronic condition to justify RPM, even though CMS does not explicitly require this. A well-documented rationale can help counter such findings and strengthen audit defenses. Documentation should include the severity and history of the condition, as well as specific RPM goals. Additionally, the medical record must reflect that the billing practitioner analyzed the transmitted data and acted on the findings. For example, if a patient’s blood pressure readings consistently exceed target thresholds, the record should document any medication adjustments, follow-up calls, or referrals made in response.

Impact on Billing Accuracy and Revenue Retention

Poor documentation not only puts revenue at risk but also increases the likelihood of audits. Around 24% of claims denials occur during the initial consultation for RPM programs, often because the medical record does not clearly justify the need for monitoring. Generic care plans, insufficient links between devices and conditions, or routine RPM billing without demonstrating medical necessity can lead to extrapolated findings across the patient panel, resulting in significant financial clawbacks. On the other hand, well-prepared documentation that outlines the clinical justification for RPM - showing how it supports treatment and improves patient outcomes - can help practices defend claims and protect revenue streams.

Ease of Implementation with Technology and Workflows

Technology can play a critical role in addressing documentation challenges. Purpose-built care management software simplifies the process by guiding clinical staff to include all necessary elements during patient enrollment and care plan development. Generic EHRs often lack RPM-specific tools such as automated time tracking, care plan versioning, and audit-ready reporting. Platforms designed for RPM can automate device details, track data, and flag documentation gaps, ensuring compliance with CMS standards before claims are submitted.

To enhance workflows, providers can use templates that prompt for key details like the condition’s severity, history, and a clear rationale for monitoring. However, these templates must be customized for each patient to avoid raising red flags for "generic care plans". For instance, two patients with diabetes might require different monitoring approaches - one focusing on glucose variability and the other on cardiovascular risks. Documentation should reflect these individualized needs. Regular internal audits can catch incomplete records before external payers do, and training clinical staff to document both the analysis of RPM data and subsequent actions reinforces the emphasis on active care management rather than passive data collection.

5. Missing Device Setup and Data Transmission Records

Accurate documentation of device setup and data transmission is critical for Remote Patient Monitoring (RPM) billing, particularly for CPT codes 99453 and 99454. However, incomplete or missing records - such as proof of device delivery, patient training, and data transmission - can render claims indefensible during audits. This oversight exposes practices to revenue clawbacks and compliance penalties. Below, we’ll explore the key documentation requirements set by CMS to ensure compliance.

Compliance with CMS Documentation Requirements

To meet CMS requirements for CPT 99453 (initial device setup and patient education), practices must document five essential elements:

A provider’s order for the device

The condition(s) being monitored

Device identification details

The date the device was delivered

The date(s) the patient received training

Auditors expect these elements to be explicitly recorded in the medical record. For CPT 99454 (device supply and data transmission), the documentation must confirm that physiologic data was transmitted for at least 16 days within a 30-day period to qualify for billing.

Some auditors interpret CMS guidelines stringently, requiring documentation that mimics a prescription format for the device, even though CMS does not explicitly mandate this. As Carrie Nixon, Managing Partner at Nixon Law Group, explains:

"Some auditors argue that no valid order exists if there isn't a document clearly labeled as an 'order' for RPM... they seem to expect to see something akin to a prescription".

This underscores the need for detailed records connecting the device to the patient’s diagnosis and treatment plan.

CPT Code | Service Description | Key Documentation Elements |

|---|---|---|

99453 | Setup & Education | Order, Condition, Device ID, Delivery Date, Training Date |

99454 | Device Supply & Transmission | Proof of 16+ days of electronic transmissions per 30-day period |

99457 | Clinical Management | 20 minutes of time, start/stop times, description of services |

Audit Readiness and Defensibility of Records

Recent reports from the Office of Inspector General (OIG) highlight concerns about RPM billing integrity, prompting Medicare Administrative Contractors (MACs) to conduct more rigorous reviews of device setup and transmission documentation. Without clear records of device delivery and training, CPT 99453 claims are vulnerable to audit failures. Similarly, if transmission logs do not verify the required 16-day threshold, CPT 99454 claims are also at risk.

Insufficient documentation can escalate to investigations under the False Claims Act, potentially resulting in civil monetary penalties and treble damages. Practices relying on manual logs or generic notes often struggle to meet auditor demands for specific, time-stamped evidence. Automated transmission tracking systems offer a more reliable solution, creating an unalterable and defensible audit trail.

Impact on Billing Accuracy and Revenue Retention

Missing or incomplete setup documentation leads to claim denials and, in some cases, audit extrapolations across a practice’s entire patient panel. For instance, a CPT 99453 claim lacking proof of device delivery or training will be denied, and systemic issues can trigger broader financial reviews. Similarly, CPT 99454 claims are invalid without evidence of 16 days of data transmission. To avoid these pitfalls, some practices audit transmission logs mid-month to identify patients who may fall short of the requirement, allowing time for intervention before the billing cycle ends.

Inadequate documentation also invites scrutiny of related management codes like CPT 99457 and 99458, as auditors may question the validity of the entire RPM program. Conversely, thorough setup and transmission records safeguard revenue and demonstrate compliance, reducing the likelihood of future audits.

Ease of Implementation with Technology and Workflows

Technology simplifies compliance by automating documentation and tracking processes. Specialized RPM platforms capture device setup details and transmission logs, eliminating the need for manual data entry. Automated alerts notify care teams when patients fail to transmit data for several days, enabling timely intervention to meet the 16-day threshold.

Standardized workflows further enhance compliance. For CPT 99453, practices can use a checklist during the initial patient visit to ensure all five required elements are documented. Training protocols should include a script covering cost-sharing responsibilities, the patient’s right to opt out, and device usage instructions, with confirmation that these discussions occurred. Encouraging patients to take daily readings rather than weekly measurements helps ensure consistent data transmission and adherence to the 16-day requirement. Regular internal audits, such as monthly or quarterly reviews of a random sample of RPM charts, can identify documentation gaps before they become audit issues.

6. Billing Code Conflicts and Eligibility Errors

Mistakes in billing code combinations or duplicate claims lead to immediate denials and potential audits. CMS has strict guidelines on code usage, billing entities, and time allocation. Failure to follow these rules or verify patient eligibility can result in lost revenue, compliance penalties, and increased scrutiny.

Accurate billing code use, supported by thorough documentation, is essential to avoid these pitfalls and safeguard revenue.

Compliance with CMS Documentation Requirements

CMS permits only one provider to bill for Chronic Care Management (CCM) or Transitional Care Management (TCM) per patient each month. If two providers submit claims for the same period, both claims will be denied. Additionally, a single provider cannot bill for both CCM and Principal Care Management (PCM) for the same patient in the same month. When billing CCM and Remote Patient Monitoring (RPM) together, providers must document 40 non-overlapping minutes - 20 minutes for each service separately - as time cannot be double-counted.

Some code combinations are outright prohibited. For example, CPT code 99091 (monthly data review) cannot be billed alongside RPM codes. Similarly, RPM and Remote Therapeutic Monitoring (RTM) cannot be billed together for the same patient in the same billing period. Practices must confirm patient eligibility before billing and ensure that RPM devices have transmitted data for at least 16 days within a 30-day period.

The sections below outline how to adhere to CMS guidelines, prepare for audits, and use technology to improve billing accuracy.

Audit Readiness and Defensibility of Records

Incomplete or inaccurate documentation not only increases audit risk but also leaves practices vulnerable to penalties for billing code conflicts. Auditors closely examine records to ensure services are not duplicated and time is properly allocated for each code. According to the 2024 Medicare Fee-for-Service Supplemental Improper Payment Data report, incorrect coding accounts for 10% of improper payments, while insufficient documentation makes up 59.9% of errors, and no documentation accounts for 8.2%.

To protect against these risks, practices should document each service's date, duration, staff involved, and specific activities performed. This level of detail is critical to counter allegations of double-billing. Without it, practices risk overpayment recovery demands and potential False Claims Act investigations, which carry penalties ranging from $13,946 to $28,619 per claim as of January 15, 2025.

Impact on Billing Accuracy and Revenue Retention

Billing code conflicts directly affect revenue cycles. They result in immediate claim denials and, in recurring cases, may lead to broader audits across a practice's patient base. For instance, if a practice routinely bills CCM and PCM for the same patient in the same month, Medicare will deny both claims and may investigate whether the errors were intentional. Similarly, overlapping time documentation will result in denials.

If a patient is already receiving care management services from another provider, additional claims for the same services will be rejected. Practices that fail to verify billing responsibility during enrollment often face denials weeks later, after services have already been delivered. This not only erases expected revenue but also creates extra administrative work to correct and resubmit claims.

Error Type | Impact on Revenue & Compliance |

|---|---|

Insufficient Documentation | 59.9% of improper payments; leads to partial or full fund recovery |

Incorrect Coding | 10% of improper payments; causes claim denials and audit triggers |

Service Duplication | Claims denied as only one provider can bill CCM/TCM per month |

Time Overlap | Non-compliance with CPT 99457 and 99490; time cannot overlap |

Ease of Implementation with Technology and Workflows

Technology can simplify compliance and reduce billing errors. Automated tools for time tracking and eligibility verification can prevent most billing code conflicts before claims are submitted. These systems can flag patients enrolled in multiple care management programs, avoiding duplicate billing. Practices should maintain separate documentation logs for services like CCM and RPM, recording start and stop times for each activity.

Before submitting claims, conduct monthly eligibility audits to catch overlapping services, such as TCM, that may conflict with CCM billing. At enrollment, confirm which provider will act as the primary billing entity for care management. This ensures only one claim is submitted per patient per month.

Referencing the National Correct Coding Initiative (NCCI) edits helps avoid unbundling errors, while Medically Unlikely Edits (MUEs) prevent over-reporting service units. Regular internal audits, such as monthly or quarterly chart reviews, can identify documentation gaps and coding errors before external audits occur.

7. Using EHRs Not Built for CCM and RPM

Standard Electronic Health Records (EHRs) are designed for episodic care, not the continuous tracking required for Chronic Care Management (CCM) and Remote Patient Monitoring (RPM). When practices attempt to stretch general-purpose EHRs to fit these needs, they often face compliance issues, audit risks, and billing errors, all of which can jeopardize revenue and regulatory compliance. This highlights the importance of systems specifically designed for CCM and RPM.

"Many Electronic Health Records (EHRs) aren't designed to handle the unique requirements of CCM, like time tracking, care plan versioning, or storing consent documentation." - Jon-Michial Carter, Co-Founder, ChartSpan

Compliance with CMS Documentation Requirements

General-purpose EHRs often fall short of meeting the Centers for Medicare & Medicaid Services (CMS) documentation standards for CCM and RPM billing. These systems typically lack tools for:

Tracking non-overlapping time across multiple care management codes

Maintaining version histories of care plans

Storing required consent disclosures

This can lead to vague manual entries that fail to meet CMS's detailed requirements, such as specifying the staff member involved, their role, and the exact tasks performed.

For RPM, CMS mandates at least 16 days of device data transmission within a 30-day period to bill CPT code 99454. General EHRs often fail to provide real-time alerts when patients fall short of this threshold, resulting in denied claims after services have already been delivered. Similarly, these systems struggle to track the 20 minutes of non-overlapping time required to bill CCM and RPM codes separately within the same month. Without automated safeguards, practices risk double-counting time, which can lead to immediate denials.

Consent management also poses challenges. CMS requires documented consent that includes disclosures about cost-sharing and the right to opt out. Standard EHRs often lack dedicated fields for this information, forcing staff to store consent documentation in generic notes, complicating audits and increasing administrative burdens.

Audit Readiness and Defensibility of Records

The limitations of general-purpose EHRs extend beyond compliance, leaving practices vulnerable during audits. These systems are not designed to create the detailed, defensible records that auditors expect. Manual data entries often result in incomplete logs, generic care plans, or missing timestamps - red flags during reviews by Medicare Administrative Contractors (MACs) or the Office of Inspector General (OIG).

"Utilizing a software platform that can accurately capture time and number of readings transmitted AND document this clearly is important for accurately documenting the requirements of these codes." - Carrie Nixon, Managing Partner, Nixon Law Group

Auditors often look for evidence of monthly care plan updates and versioning to confirm ongoing clinical engagement. Standard EHRs frequently overwrite older versions, erasing the audit trail necessary to demonstrate compliance. These systems also struggle to track clinical staff time across the month, making it difficult to defend CCM and RPM claims that rely on contributions from non-physician staff working under direct supervision.

Documentation Requirement | General EHR Capability | Optimized System Capability |

|---|---|---|

Time Tracking | Manual entry/Notes | Automated start/stop timers |

RPM Data Logs | Manual upload of values | Automated transmission counting (16-day rule) |

Care Plan History | Often overwrites previous versions | Maintains monthly versions for audit trails |

Consent Management | Scanned PDF or generic note | Date-stamped, specific disclosure logging |

Impact on Billing Accuracy and Revenue Retention

The inefficiencies of standard EHRs directly impact billing accuracy and revenue. Without tools to track the 16-day RPM transmission requirement, practices often submit claims that are denied outright. Similarly, vague or overlapping time logs lead to rejections for both CCM and RPM claims, even when services have been legitimately provided. These denials not only reduce expected revenue but also create additional administrative work to correct and resubmit claims, often long after the billing cycle has closed.

Another issue is the risk of duplicate billing. Without integrated compliance alerts, practices may inadvertently bill CCM and Transitional Care Management (TCM) for the same patient in the same month, triggering denials and raising audit concerns. Additionally, the lack of real-time eligibility checks means staff may not realize another provider is already billing for care management services until the claim is rejected.

Ease of Implementation with Technology and Workflows

Purpose-built systems address these gaps by replacing manual processes with automated tools, significantly reducing documentation errors before claims are submitted. These platforms automatically record the date, duration, and clinical staff role for every interaction, creating audit-ready records with minimal administrative effort. They also generate alerts when patients fall below the 16-day transmission threshold for RPM or the 20-minute threshold for CCM, allowing staff to intervene proactively.

Structured care plan templates ensure that documentation aligns with the SMART framework (Specific, Measurable, Achievable, Relevant, Time-bound), replacing generic notes with patient-specific goals and monthly updates. This approach not only satisfies auditors but also enhances clinical outcomes by emphasizing measurable progress. Centralized consent management further simplifies compliance by storing verbal or written consent in a consistent, accessible format with mandatory disclosures.

Regular internal audits can help practices identify issues like "note bloat" or missing signatures before external reviews occur. Monthly eligibility checks ensure that only one provider bills for care management services per patient, reducing the risk of overlapping claims. Leveraging tools like the National Correct Coding Initiative (NCCI) edits and Medically Unlikely Edits (MUEs) helps practices avoid unbundling errors and over-reporting service units.

8. Unclear Team Roles and Clinical Oversight Documentation

CCM and RPM programs rely on contributions from a variety of healthcare professionals. However, when documentation fails to clearly identify staff roles, practices risk claim denials. CMS requires that every interaction include the staff member's name, their clinical role, and a detailed description of the activity performed. Just as precise time tracking and care plan details are critical, clearly defining team roles is essential for protecting revenue and ensuring compliance.

Compliance with CMS Documentation Requirements

CMS regulations specify that clinical staff must dedicate at least 20 minutes per month to non–face-to-face CCM activities for code 99490. Documentation must clearly outline who contributed that time, including their name, role, and specific activities performed. Generic or vague entries fail to meet compliance standards. Additionally, the billing practitioner must actively oversee the process, reviewing and approving care plans created by clinical staff. This oversight ensures that services are “directed by a physician or other qualified healthcare professional”.

"Vague entries like 'care coordination – 20 minutes' can result in noncompliant records that won't support billing if audited." - Jon-Michial Carter, Co-founder, ChartSpan

Another frequent issue is the failure to document which provider is designated as the billing entity. CMS permits only one provider to bill for CCM or Transitional Care Management (TCM) services per patient each month. Without clear documentation, duplicate claims may occur, leading to denials [1][5]. Practices should confirm and record the billing provider during the initial consent process to prevent such errors. This aligns with broader compliance challenges where incomplete documentation undermines audit readiness.

Audit Readiness and Defensibility of Records

Auditors expect detailed documentation that identifies who performed each service, shows provider oversight, and includes evidence of care plan approval. Using generic terms like "staff" instead of specifying names and roles is a red flag for auditors and can result in claim denials. Similarly, care plans that lack provider sign-off fail to demonstrate the clinical oversight required by CMS.

Care transitions are another area prone to lapses in responsibility. When no specific team member is assigned to manage alerts or reconcile medications after a hospital discharge, critical tasks can be missed. Auditors look for a "longitudinal view" of the patient's care, which includes consistent documentation of team roles and coordination with external providers.

Documentation Element | Requirement for Compliance | Common Error |

|---|---|---|

Staff Identification | Name and clinical role (e.g., RN, MA) | Missing or generic "staff" label |

Time Tracking | Exact minutes spent per activity | Rounded estimates or vague totals |

Clinical Oversight | Provider review/approval of care plan | Care plan created by staff without sign-off |

Billing Provider | Single identified billing entity | Multiple providers billing for the same patient |

Activity Detail | Specific description (e.g., "medication reconciliation") | Generic "care coordination" or "patient outreach" |

Impact on Billing Accuracy and Revenue Retention

Inadequate documentation of team roles can lead to denied claims and lost revenue. Claims submitted without proper attribution of staff are rejected outright. Errors in attributing services to the wrong provider or failing to comply with "incident-to" billing rules add further risks.

Duplicate billing, where multiple providers unknowingly bill for the same patient, triggers claim denials and often leads to increased audit scrutiny. Correcting these errors - resubmitting claims, addressing audits, and recovering lost revenue - creates a significant administrative burden and adds operational costs long after the billing cycle ends.

Streamlining Compliance with Technology and Workflows

Technology can simplify the process of documenting staff roles and clinical oversight. EHR systems with built-in templates that require staff role selection and structured fields for activity descriptions help prevent vague or incomplete entries before claims are submitted. These platforms can automatically log details such as dates, durations, and clinical credentials, producing audit-ready records with minimal manual effort.

Assigning specific team members - such as a transitions nurse or dedicated care manager - to oversee high-priority tasks like hospital discharge follow-ups ensures accountability. This approach minimizes the risk of overlooked alerts or unaddressed tasks. Additionally, conducting monthly eligibility checks helps confirm that only one provider is billing for care management services per patient. Regular internal audits can further identify issues like missing signatures or incomplete staff attribution, helping practices maintain a coding accuracy rate of 90% or higher, which is the standard for audit compliance.

Clear documentation of team roles is not just a best practice - it’s a critical step in ensuring accurate billing and protecting revenue streams. For more insights on optimizing your digital health strategy, visit our learning center.

9. Incomplete Patient Interaction and Care Coordination Logs

Accurate and complete patient interaction logs are a cornerstone for successful billing in Chronic Care Management (CCM) and Remote Patient Monitoring (RPM). However, incomplete or vague documentation often leads to claim denials. According to CMS regulations, every care coordination activity must include the date, exact duration, a detailed description of the service provided, and the name and role of the staff member involved. For example, entries like "care coordination – 20 minutes" or logs that omit evidence of required interactive communication for RPM can jeopardize both revenue and compliance. Below, we’ll explore the steps to meet CMS standards and safeguard your practice’s revenue through precise documentation.

Compliance with CMS Documentation Requirements

Time tracking for CCM and RPM services must align with strict CMS guidelines. For non-complex CCM (CPT 99490), at least 20 minutes of non–face-to-face clinical staff time per calendar month is required. Complex CCM (CPT 99487), on the other hand, demands 60 minutes and involves moderate-to-high complexity medical decision-making. Similarly, RPM management (CPT 99457) necessitates 20 minutes of monthly service, including interactive communication such as a phone or video call with the patient or caregiver. Notably, time spent during in-office visits cannot be applied toward these minimums.

When patients receive both CCM and RPM services, the time for each must be logged separately. As Nancy Rowe, CPC, CPMA, CRC at Practice Provider Corp, explains:

"Time spent providing these services cannot be counted towards the required time for both CCM and RPM in a single month. For example, if a patient is receiving CCM services which require 20 minutes... as well as RPM monitoring which require another 20 minutes, these times cannot overlap."

This means practices must document distinct, non-overlapping 20-minute blocks for CCM and RPM to avoid duplication issues. Logs should detail specific activities, such as care plan updates, medication reviews, coordination with external providers, or patient education. Avoid generic terms like "patient outreach." Instead, specify tasks, e.g., "10 minutes reviewing lab results and updating care plan." Each log must include start and stop times, a clear description of the activity, and the name and role of the clinician involved. This level of detail not only ensures compliance but also strengthens audit readiness.

Audit Readiness and Defensibility of Records

Auditors closely examine time-based codes, and incomplete logs are a major red flag. Both CMS and commercial payers often deny claims if the documentation fails to justify the required service time. Medicare, in particular, is vigilant about incomplete or unclear records, which can lead to claim denials or even repayment demands.

Detailed logs serve as your best defense during audits, providing clear evidence that services were delivered in accordance with coverage requirements. Without this level of documentation, practices risk having payments questioned or clawed back. Accurate and thorough records are not just about meeting CMS requirements - they are essential for protecting your revenue.

Impact on Billing Accuracy and Revenue Retention

Incomplete or vague documentation directly affects your bottom line. Claims lacking sufficient detail are often denied, forcing resubmissions or appeals that increase administrative burdens. Worse, if documentation fails to justify the billed services, payments already received may be flagged as overpayments and subject to recovery. Overlapping billing with other providers due to unclear enrollment dates can also lead to denials, with only the first provider to submit receiving payment.

The financial stakes are high. For instance, Medicare reimburses approximately $59.86 per month for RPM management (CPT 99457) and $64.02 per month for non-complex CCM (CPT 99490). Errors that result in claim denials disrupt these recurring revenue streams and increase operational costs as staff work to resolve the issues.

Streamlining Compliance with Technology and Workflows

Technology offers practical solutions to reduce manual errors and ensure compliance. Automated time-tracking tools can log start and stop times, staff roles, and patient activities, ensuring that the required 20 minutes per month for both CCM and RPM are accurately documented. Purpose-built platforms often include structured templates that require all necessary details - such as date, duration, activity, and staff role - before a record can be saved.

Automated alerts can notify staff when RPM data transmission falls short or when interactive communication requirements haven’t been met. Additionally, AI-driven auditing tools can flag potential errors, allowing human reviewers to focus on correcting only the flagged entries. Regular internal audits can further identify incomplete logs or overlapping time blocks before claims are submitted, reducing denials and safeguarding revenue.

CPT Code | Service Type | Minimum Time Requirement | Key Documentation Requirement |

|---|---|---|---|

99490 | Non-Complex CCM | 20 minutes/month | Non–face-to-face clinical staff time |

99487 | Complex CCM | 60 minutes/month | Moderate-to-high complexity medical decision making |

99457 | RPM Management | 20 minutes/month | Must include interactive communication (e.g., phone or video) |

99458 | RPM Add-on | Additional 20 minutes | Documentation of additional management time |

Accurate and detailed documentation, supported by technology, ensures compliance, reduces administrative burdens, and protects your practice’s financial health. By adhering to these standards, you can mitigate risks and focus on delivering effective patient care.

10. Poor Audit Preparation and Record Retention Practices

Failing to maintain organized records and prepare adequately for audits can expose healthcare practices to financial risks and compliance violations. When auditors request documentation to validate billed services, providers must supply clear, accurate records demonstrating eligibility, patient consent, time tracking, and medical necessity. Without a structured system for record organization, practices face claim denials, demands for overpayment recovery, and potential penalties under the False Claims Act, which range from $13,946–$14,308 per claim to $27,894–$28,619 per claim as of January 15, 2025.

Compliance with CMS Documentation Requirements

Proper record retention is an essential component of audit readiness, particularly when addressing CMS documentation standards. Providers are required to maintain detailed records for all billed Chronic Care Management (CCM) and Remote Patient Monitoring (RPM) services. For CCM, documentation must include proof of eligibility, patient consent, care plans, and logs showing 20+ minutes of care. For RPM, records must verify 16 days of device data and at least 20 minutes of interactive communication. Recovery Audit Contractors (RACs) are authorized to review claims up to three years retrospectively to identify improper payments, and some organizations retain consent records for as long as 10 years to ensure defensibility.

Audit Readiness and Defensibility of Records

Auditors often flag issues such as uniform billing for the same service levels, unbundling of codes, and utilization patterns that deviate from national benchmarks. Insufficient documentation is a leading cause of improper Medicare payments, accounting for 59.9% of such errors, followed by medical necessity issues (15.7%) and incorrect coding (10%). To mitigate these risks, healthcare organizations aim for at least 90% coding accuracy. If an audit sample reveals a financial error rate of 5% or higher, a full review of systems and additional samples may be required. Michelle Dick, Development Editor at AAPC, highlights the stakes:

"Missing or insufficient documentation means there is no justification for the medical services or level of care billed, and if Medicare already paid... it may be considered an overpayment and partially or fully recovered".

To withstand audit scrutiny, practices must be able to quickly produce detailed, contemporaneous records that include the date, staff credentials, exact duration, and specific descriptions of activities performed.

Impact on Billing Accuracy and Revenue Retention

Disorganized or incomplete record-keeping can lead to revenue losses through claim denials and refund demands. Auditors often reject claims outright or request repayment when documentation is insufficient. Additionally, if Medicare or other payers determine that a service was medically unnecessary after payment, they will require reimbursement of the overpayment, often with added interest. Poor audit outcomes not only result in financial losses but also increase administrative burdens on staff, diverting resources from patient care.

Ease of Implementation with Technology and Workflows

Technology offers practical solutions for improving audit readiness and record retention. Automated systems can streamline documentation, ensuring that care plans, time logs, consent forms, and device data are stored in centralized, searchable repositories. Time-tracking software can log start and stop times, staff roles, and patient activities, providing objective evidence for audits. AI-powered tools can review all documentation, flagging potential errors for correction before claims are submitted.

Regular internal audits - conducted monthly or quarterly - allow practices to identify and address documentation gaps before external reviews occur. Standardized electronic scripts or checklists can ensure consistent documentation of CMS-required disclosures, while monthly eligibility checks help prevent duplicate or overlapping claims that could trigger denials. These tools and workflows align with the broader goal of leveraging specialized platforms to simplify and improve documentation processes.

CCM vs. RPM Documentation Requirements

Building on earlier discussions about documentation errors, this section highlights the differences between Chronic Care Management (CCM) and Remote Patient Monitoring (RPM) requirements. Although CCM and RPM are often billed together, they have distinct documentation standards. Recognizing these differences is essential to prevent claim denials, audit complications, and revenue loss.

CCM emphasizes the coordination of care for patients with two or more chronic conditions expected to persist for at least 12 months. It requires a detailed electronic care plan and a minimum of 20 minutes of non-face-to-face care coordination each month. RPM, on the other hand, focuses on tracking specific physiologic data, such as blood pressure or weight. Its documentation must include proof of medical necessity, device setup records, at least 16 days of data transmission within a 30-day period, and 20 minutes of interactive communication with the patient or caregiver. These distinctions underline the unique requirements of each program.

Below is a comparison of key documentation elements, common pitfalls, and potential consequences for CCM and RPM:

Feature | Chronic Care Management (CCM) | Remote Patient Monitoring (RPM) |

|---|---|---|

Primary Focus | Coordinating care for 2+ chronic conditions | Monitoring specific physiologic parameters |

Eligibility | Two or more chronic conditions expected to last 12+ months | Medical necessity for physiologic monitoring |

Care Plan Requirement | Comprehensive electronic plan addressing multiple conditions | Documentation focused on the specific monitoring rationale |

Data Threshold | No specific data transmission requirement | At least 16 days of device data per 30 days |

Time Requirement | 20+ minutes of clinical staff time per month | 20+ minutes of interactive communication per month |

Common Error | Using generic templates or failing to document consent | Insufficient data transmission or missing medical necessity documentation |

Consequence | Claim denial, audit risks, and revenue loss | Loss of CPT 99454 reimbursement (approximately $77.64) |

It’s crucial to maintain separate, non-overlapping logs for CCM and RPM services. As Nancy Rowe, CPC, CPMA, CRC, explains:

"Time spent providing these services cannot be counted towards the required time for both CCM and RPM in a single month".

The table above illustrates these differences, emphasizing the documentation requirements for each program. Tools like OnCare360 simplify compliance by automating time tracking, issuing alerts for RPM data thresholds, and providing detailed care plan templates. These features ensure accurate billing, verify RPM device data transmission, and secure complete consent documentation, including cost-sharing and opt-out provisions.

Conclusion

As discussed earlier, precise and automated documentation in Chronic Care Management (CCM) and Remote Patient Monitoring (RPM) is essential to ensure compliance and safeguard revenue. Documentation errors in these programs pose serious financial and regulatory risks, extending well beyond simple claim denials. For example, insufficient documentation accounts for a striking 59.9% of all improper Medicare payments. Moreover, penalties under the False Claims Act have increased to as much as $28,619 per claim as of January 15, 2025. Most denials are tied to process failures - such as missing consent forms, incomplete time logs, generic care plans, or inadequate RPM data transmission - rather than patient ineligibility. These issues, detailed earlier, highlight the critical need for strong compliance systems to avoid audits, revenue recovery demands, or, in severe cases, investigations by the Department of Justice.

Oversight of virtual care services has become even more stringent following the September 2024 OIG report. Attorney Carrie Nixon observes:

"We are now seeing a significant increase in audits".

Medicare Administrative Contractors (MACs) are now conducting detailed manual reviews, focusing on practitioner orders, verbal consent records, and documentation of medical necessity. Practices relying on standard Electronic Health Records (EHRs) not tailored for CCM and RPM workflows are particularly at risk. These systems often lack essential features like automated time tracking, data transmission alerts, and structured care plan templates that auditors expect.

Experts have noted that inadequate documentation exposes providers to overpayment recovery demands. Addressing these vulnerabilities requires purpose-built platforms and standardized workflows that automate compliance tasks. For instance, solutions like OnCare360 offer capabilities such as precise start-and-stop time tracking with staff attribution, alerts for RPM devices that fail to transmit data for at least 16 days, and audit-ready logs that comply with Medicare Administrative Contractor (MAC) and OIG requirements. These tools help eliminate common pitfalls like "note bloat" and manual tracking errors, which are frequent issues with general EHRs, while ensuring all billable services meet CMS documentation standards.

To mitigate risks and maintain compliance, healthcare organizations should focus on implementing specialized technology and standardized workflows. With the improper Medicare payment rate at 7.7% and regulatory scrutiny only increasing, prioritizing documentation accuracy is essential to protect revenue, sustain program performance, and avoid costly legal consequences. Investing in compliance-focused tools and processes now can ensure success in an environment of heightened audits and oversight.

FAQs

How does technology enhance compliance in CCM and RPM documentation?

Technology plays a crucial role in simplifying the documentation process for Chronic Care Management (CCM) and Remote Patient Monitoring (RPM), while ensuring adherence to CMS requirements. Integrated electronic health record (EHR) systems, for instance, can automatically capture critical details like patient consent, service dates, staff involvement, and cost-sharing information. This automation removes the burden of manual paperwork, saving time and reducing errors.

Advanced tools also help track the time spent on care activities, ensuring accurate documentation for billing codes such as 99490 (CCM) and 99457 (RPM), which require a minimum of 20 minutes. Real-time alerts further enhance accuracy by flagging missing components, such as incomplete care plans or unlogged patient interactions. These proactive measures help address issues before claims are submitted, reducing denial rates and safeguarding program revenue.

Moreover, analytics dashboards provide a comprehensive view of documentation metrics, generating reports that meet CMS audit standards. By automating billing workflows and applying the correct CPT codes and modifiers, these technologies significantly lower the risk of coding errors and audits, making compliance both straightforward and efficient.

What are the main differences in documentation requirements for CCM and RPM?

Chronic Care Management (CCM) and Remote Patient Monitoring (RPM) share some procedural requirements, such as obtaining patient consent and tracking staff time, but their objectives and methods differ significantly.

CCM is centered around creating and maintaining a care plan that addresses all eligible chronic conditions. It requires providers to document at least 20 minutes of non-face-to-face care each month, ensure patients have 24/7 access to a care team, and secure signed patient consent. Additionally, CCM involves coordinating with other Medicare services to prevent overlapping care.

In contrast, RPM is rooted in technology use and data-driven care. Providers must document the initial setup of the monitoring device, patient education on its use, and the supply and daily operation of the device. For billing purposes, RPM also requires proof of at least 16 days of patient-generated data within the billing period and a minimum of 20 minutes of monitoring time each month. While CCM prioritizes overall care coordination, RPM focuses on leveraging devices for data collection and analysis.

Why is it important to track time accurately for CCM and RPM billing?

Accurate time tracking plays a key role in billing for Chronic Care Management (CCM) and Remote Patient Monitoring (RPM), as these services depend on time-based codes. These codes mandate precise documentation of the minutes spent to meet the specific thresholds established by the Centers for Medicare & Medicaid Services (CMS).

Incomplete or inaccurate time logs can result in denied claims or improper payment flags, which may lead to revenue losses and compliance challenges. By keeping thorough and accurate time records, healthcare providers can secure appropriate reimbursement and minimize the risk of audits.

Top 10 CCM and RPM Documentation Errors with Compliance Impact

1. Missing or Invalid Patient Consent

Patient consent plays a critical role in Chronic Care Management (CCM) and Remote Patient Monitoring (RPM) claims. Without proper documentation, your practice cannot prove that patients voluntarily enrolled or understood their rights and financial responsibilities. This gap can lead to claim denials and lost revenue.

Compliance with CMS Documentation Requirements

The Centers for Medicare & Medicaid Services (CMS) accepts both verbal and written consent for CCM and RPM services, but the documentation must meet specific requirements. Your records should confirm that patients were informed about cost-sharing obligations (such as deductibles and copays), their right to opt out at any time (with changes effective at the end of the billing month), and the rule that only one provider can bill for CCM services during a given period.

Each consent record needs to include:

The date consent was obtained.

The name and role of the staff member who secured it.

Confirmation that all required elements were explained to the patient.

Unlike other programs, CCM consent remains valid indefinitely unless the patient revokes it or switches providers. There’s no need for annual renewals. If two providers mistakenly bill for the same patient in a single month, CMS typically pays the provider with the earlier consent date on record. Keeping thorough documentation ensures compliance and strengthens your position during audits.

Audit Readiness and Defensibility of Records

Auditors don’t just check for the existence of consent - they also assess whether your documentation clearly outlines what was communicated to the patient during enrollment. Missing elements in consent records are a common compliance issue. To prepare for audits, store all consent documentation in a consistent and easily accessible location within your electronic health record (EHR) system. Each entry should link the consent to a specific clinical staff member, as required by CMS standards.

Impact on Billing Accuracy and Revenue Retention

Incomplete or missing consent is a leading cause of claim denials and revenue loss. Without clear documentation, your practice cannot confirm that patients voluntarily enrolled or understood their financial responsibilities, putting related claims at risk. To avoid accidental double billing - and the denials that follow - confirm that patients aren’t already receiving CCM services from another provider before enrollment.

Streamlining Compliance with Technology and Workflows

To reduce errors and protect revenue, consider using a standardized consent checklist to ensure your staff consistently covers all required disclosures during enrollment. Technology can also help by flagging patients who lack documented consent and securely storing records for the required retention period - up to 10 years in some cases. Regular internal audits can catch missing or incomplete consent forms before external auditors do, helping to safeguard your practice’s financial health.

2. Incomplete or Unverifiable Time Tracking

Accurate time tracking is a cornerstone for billing Chronic Care Management (CCM) and Remote Patient Monitoring (RPM) services. Without precise logs of staff time, you cannot substantiate the Centers for Medicare and Medicaid Services (CMS) requirement of 20 minutes per month for basic CCM (CPT 99490) and RPM treatment management (CPT 99457).

Compliance with CMS Documentation Requirements

CMS mandates that time logs include four key elements: the date of service, the exact duration in minutes (not rounded), a detailed description of the activity, and the name and clinical role of the staff member involved. Generic entries like "care coordination – 20 minutes" are insufficient and may fail an audit. Instead, documentation should specifically describe the activities performed, such as "10 minutes reviewing lab results and updating the diabetes care plan."

Qualifying activities include tasks like care plan development, medication reconciliation, coordination with specialists, patient education, and interpreting physiological data from RPM devices. However, time spent on in-person visits or same-day Evaluation and Management (E/M) services is excluded. For patients receiving both CCM and RPM in the same month, you must document a total of 40 minutes - 20 minutes for each program separately, as CMS prohibits double-counting the same time block.

"A note that simply says '20 minutes of CCM activity' is highly likely to be identified as noncompliant." - DrKumo

Detailed documentation not only meets CMS requirements but also strengthens your audit trail.

Audit Readiness and Defensibility of Records

Beyond compliance, audit readiness hinges on maintaining defensible, precise time logs. Medicare audits often evaluate whether your documentation demonstrates how the recorded time directly addresses a patient's chronic conditions and associated risks. Incomplete or vague entries can raise red flags. Nationally, the accuracy rate for proper Medicare payments is 92.3%, with an improper payment rate of 7.7%, largely due to insufficient documentation. If your records fail to justify the services billed, CMS may deny payment or seek to recover funds as overpayments.

To bolster audit defense, conduct monthly or quarterly internal reviews of random charts to confirm they meet the 20-minute threshold and include itemized activity logs. Ensure every record includes appropriate signatures; if a signature is handwritten and illegible, provide a signature log or attestation. Automated tools that generate time-stamped, immutable audit trails can mitigate the risk of manual errors and ensure compliance with Medicare's minute-by-minute tracking requirements.

Impact on Billing Accuracy and Revenue Retention

Failure to meet documentation standards directly impacts billing accuracy and revenue. Incomplete time tracking can result in claim denial rates as high as 4.8%. When staff fail to log activities in real-time or rely on generic templates, practices risk underbilling (losing revenue) or overbilling (triggering audits and potential recoupments). Conversely, thorough documentation helps secure the full reimbursement for care management services and shields practices from compliance penalties.

Well-documented CCM programs can also improve patient outcomes. For instance, proactive care management has been shown to reduce hospitalizations by up to 65% and emergency room visits by 44.3% for patients with COPD, while lowering the risk of hospital readmission by 21% for those with heart failure or COPD. These outcomes depend on demonstrating consistent, high-quality care coordination, which begins with accurate time tracking.

Ease of Implementation with Technology and Workflows

Specialized care management software simplifies compliance by creating time-stamped, unalterable audit trails, removing the need for manual entry. Many standard electronic health records (EHRs) lack features like care plan versioning or aggregation of non-face-to-face time, increasing the risk of documentation errors. Purpose-built platforms can automate reminders for patient outreach, helping staff consistently meet the 20-minute monthly threshold.

Standardizing workflows with a checklist can further improve accuracy. Include prompts for staff to record the date, duration, role, and specific activity for each patient interaction. Train staff regularly on real-time time tracking and verify that patients aren’t receiving overlapping services, such as Transitional Care Management (TCM).

CPT Code | Service Type | Minimum Time Requirement | Key Documentation Focus |

|---|---|---|---|

99490 | Basic CCM | 20 minutes/month | Non-face-to-face clinical staff time |

99457 | RPM Treatment | 20 minutes/month | Interactive time and data interpretation |

99458 | RPM Add-on | +20 minutes (40 total) | Additional interactive time |

99491 | CCM (Provider) | 30 minutes/month | Physician or qualified professional time |

3. Generic, Outdated, or Template-Only Care Plans

Beyond consent and time tracking, the quality of care plans plays a pivotal role in ensuring compliance and maintaining steady revenue. Patient-specific care plans are a cornerstone of compliant Chronic Care Management (CCM) and Remote Patient Monitoring (RPM) billing. Unfortunately, many practices fall into the trap of reusing generic templates, neglecting regular updates, or omitting critical components like measurable goals and coordination details. These oversights are red flags for CMS and auditors, often leading to deeper scrutiny, claim denials, or payment recoupment.

Compliance with CMS Documentation Requirements

CMS mandates that every CCM care plan include specific diagnosis codes, measurable SMART goals, medication management (including allergies), planned interventions, and specialist coordination. All of this must stem from a current, person-centered assessment. Over-reliance on generic templates jeopardizes compliance and raises risks during audits.

To meet CMS standards, care plans should follow the SMART framework - goals must be Specific, Measurable, Actionable, Relevant, and Timed. For instance, instead of a vague directive like "manage hypertension", a care plan should outline clear objectives, such as "reduce systolic blood pressure to below 130 mmHg within six months through medication adjustments and dietary changes." Care plans must also be updated at least annually or whenever a patient’s condition changes. Failure to document these updates can result in noncompliance.

"A CCM care plan should be patient-specific and regularly updated. But in practice, some plans are duplicated from templates, too general to be meaningful, or not revised month-to-month." - Jon-Michial Carter, ChartSpan

CMS also requires that the initial care plan be developed in person by the billing practitioner. While clinical staff can assist with updates, the practitioner must review and sign off on all revisions.

Audit Readiness and Defensibility of Records

Auditors prioritize detailed, patient-specific documentation that demonstrates active care management. Generic or outdated plans are a major warning sign. When care plans are copied from templates or lack regular updates, they weaken the defensibility of records during Medicare audits.

For audit readiness, ensure care plans are accessible 24/7 to the entire care team and available to patients or their caregivers in electronic or paper formats. Every revision should be documented with a date stamp and a clear explanation of the changes - such as adding a new specialist referral or adjusting medications post-hospitalization. Purpose-built CCM software can simplify this process, offering automated versioning and real-time tracking that standard EHRs often lack. This level of documentation not only satisfies auditors but also supports accurate billing and revenue retention.

Required Care Plan Element | Description for Compliance |

|---|---|

Problem List | Chronic conditions with specific diagnosis codes |

Measurable Goals | SMART goals: Specific, Measurable, Actionable, Relevant, Timed |

Medication Management | Current medication list and allergy details |

Planned Interventions | Therapies, monitoring strategies, and assigned responsibilities |

Coordination Details | Collaboration with specialists and external agencies |

Periodic Review | Updates and revisions scheduled at least every 12 months |

Impact on Billing Accuracy and Revenue Retention

Neglecting compliant care plans can directly jeopardize revenue. Claims for CCM (CPT 99490) and Principal Care Management are often denied if care plans fail to meet CMS requirements for specificity, accessibility, and documentation. With annual revenue from a single CCM patient ranging between $1,130.23 and $2,238.68, inadequate care plans put significant income at risk. Moreover, generic templates often fail to demonstrate medical necessity and a clear rationale for monitoring - key elements for RPM reimbursement.

When care plans are not updated to reflect clinical changes, practices risk billing errors. For example, if a patient is hospitalized and the care plan isn’t updated within seven days to include reconciled medications and follow-up instructions, the practice may fail to meet Transitional Care Management (TCM) documentation requirements, forfeiting reimbursement. On the other hand, regularly updated care plans help ensure full reimbursement and protect against compliance penalties.

"In the eyes of CMS, if it is not documented, it did not happen." - Justin Brochetti, CEO, Intelligence Factory

Ease of Implementation with Technology and Workflows

Specialized care management software can significantly simplify compliance by creating care plan drafts using real-time patient data, automatically tracking updates, and ensuring all CMS-required elements are included. Many standard EHRs lack features like versioning or the ability to easily share care plans with the entire care team and patients, increasing the likelihood of documentation errors. Purpose-built platforms can also prompt staff to update care plans on a regular schedule and flag overdue revisions.

To move away from generic templates, establish workflows that require customization. Internal templates can serve as a foundation, but clinical staff must tailor sections like planned interventions and symptom management for each patient. For example, two patients with diabetes may have vastly different goals - one focusing on weight loss, the other on preventing hypoglycemia - and care plans should reflect these individualized priorities. Regular internal audits can further ensure care plans remain specific and up to date.

4. Lack of Medical Necessity Documentation for RPM

For Remote Patient Monitoring (RPM) claims to be approved, they must demonstrate that the service is both reasonable and necessary for diagnosing or treating a patient’s condition. Without proper documentation, claims are at risk of being denied, and audits may follow. A common misconception among providers is that enrolling a patient in RPM and collecting device data is enough. However, CMS and auditors require a detailed explanation of why RPM is appropriate for the patient’s specific diagnosis and treatment plan.

Compliance with CMS Documentation Requirements

According to CMS, medical necessity refers to services that are "reasonable and necessary for the diagnosis or treatment of illness or injury or to improve the functioning of a malformed body member". This means documentation must directly link the RPM device to the patient’s condition and treatment plan. Auditors look for a clear order in the medical record’s assessment and plan section, explaining the need for RPM, the expected duration, the type of device, its relevance to the condition, and the physiological metrics being monitored. Each RPM record should be tailored to the patient and updated as needed. For device supply billing (CPT 99454), patients must transmit at least 16 days of data within a 30-day period.

"In order for a claim for services to be paid by Medicare, the ordering practitioner must determine that a service is 'medically necessary' – meaning, it is reasonable and necessary for the diagnosis or treatment of the patient's condition." – Carrie Nixon, Managing Partner, Nixon Law Group

Documentation Element | CMS Requirement / Auditor Expectation |

|---|---|

Patient Relationship | Must be an established patient for RPM |

Condition Type | Must be an acute or chronic condition |

Device Type | Must meet FDA definition of a medical device |

Data Collection | 16 days of readings per 30-day period for billing |

Care Plan Details | Include RPM need, duration, device type, and metrics |

Clinical Oversight | Services must be under general supervision |

This structured approach ensures compliance and prepares providers for audit scrutiny.

Audit Readiness and Defensibility of Records

Audits of RPM services have become more stringent in recent years. As previously mentioned, thorough documentation is essential to defend against penalties. Auditors closely examine treatment plans to confirm that medical necessity is clearly documented. Inadequate records can lead to investigations under the False Claims Act. Some auditors incorrectly demand evidence of a "precipitating event" or worsening of a chronic condition to justify RPM, even though CMS does not explicitly require this. A well-documented rationale can help counter such findings and strengthen audit defenses. Documentation should include the severity and history of the condition, as well as specific RPM goals. Additionally, the medical record must reflect that the billing practitioner analyzed the transmitted data and acted on the findings. For example, if a patient’s blood pressure readings consistently exceed target thresholds, the record should document any medication adjustments, follow-up calls, or referrals made in response.

Impact on Billing Accuracy and Revenue Retention